Today, billions of transactions happen within seconds between merchants, processors, card networks, and banks. An in-store terminal, online web interface, or in-office process initiates the transaction. Payment information is sent from the merchant's processor to the card network and the issuer's processor for approval.

After verifying that the transaction information is valid, the issuer/processor authorizes the cardholder to complete the purchase.

The issuer/processor will then send the authorization response through the card network and end up at the merchant terminal with the response back to the cardholder. The whole process takes place in milliseconds - and while it seems simple, the emitter/processor can handle a lot of complexity.

What is a Payment Processor?

Businesses use a payment processor as a vendor for managing the backend side logistics of accepting card payments. It shuttles the card data from where customers swipe, tap or enter their debit or credit card details to the payment networks such as Mastercard, American Express, Visa, and Discover – and banks associated with the transaction.

A payment processor is a mediator for the credit card transaction process between the financial institutions and the merchant involved. A processor can regulate credit card transactions and operate to ensure merchants get their payments on time by providing the transfer of funds. Some payment processing services offer instruments for card acceptance, PCT compliance support, security solutions, customer support, and other value-added payment processing services.

If your business accepts card payments, the requirement of a payment processor is a must. Some companies integrate payment processing with hardware and point-of-sale systems, while other businesses, such as Payment Depot, integrate only on payments. The best alternative is based entirely on your business sales volume and mode of accepting payments.

How Do Payment Processors Work?

The payments ecosystem is perplexed, with numerous terms and jargon to become used to. But the entire thing is comparatively more straightforward. If you are not entirely sure what happens when your customers are about to pay using a debit or credit card, here's a simple step procedure that makes you understand clearly:

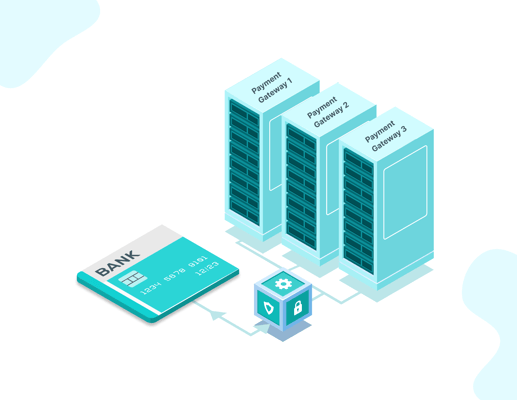

- The check-out procedure is completed only by the customer when they pay by debit or credit card, submitting their card details.

- In this step, the merchant transfers the financial details of the cardholder to the payment gateway.

- After obtaining the financial transaction details, the payment gateway transfers the details to the third-party processor used by the merchant.

- The payment processor will transfer the transaction details to the card network (Mastercard or Visa) in this step.

- The card network will transfer the transaction details to the customer's bank, which examines whether sufficient funds are in the account to complete the transaction.

- In this step, the card network submits the response, which details whether the transaction has been accepted or declined.

- The card network passes on the response to the payment processor. The payment processor further transfers the response to the payment gateway, informing the merchant and customer of the response.

- Lastly, the customer's bank deposits the funds into your merchant account, which will take a few minutes for an agreed period before they are paid into your business account.

Things To Consider When Looking for a Payment Processor

Transaction cost is one of the processing factors, but there are other key considerations to opt for when selecting a payment processor. Look at the entire cost of the processing service. This includes monthly fees, transaction fees, chargeback fees, and less-definite costs such as setup costs, membership fees, PCI compliance fees, and cancellation fees. The total monthly cost needs to be taken into consideration at the time of comparing services.

Let us take a look at the primary things which are required in implementing a payment processor.

1. PCI Compliance

PCI Compliance, also known as PCI DSS, stands for Payment Card Industry Data Security Standards. They are a combination of general practices- regulated by the numerous credit card companies willing to ensure cardholder details are stored, transmitted, and handled protectively. They set out the operational and technical requirements for any company/organization that approves or processes payment transactions, along with the manufacturers and developers associated with producing devices or applications involved in these transactions.

2. Integrated Payments

Many small businesses consider payment processing as an isolated item in their operations. When a new transaction comes, these businesses must enter the payment data in whatever software and tools they use. However, this manual data entry is time-taking. It's also vulnerable to human error.

But when the setup is right, it's possible to automate the whole process with payment integration solutions that seamlessly sync incoming transactions with the CRM, accounting, and other software platforms you currently use for running your business.

3. Reconciliation

Reconciliation is used to examine all business transactions, including income and expenses. Businesses use online payment gateways to use dashboards for reconciling payments. These dashboards are built to support merchants in getting a detailed record of payments they have received from customers.

Having payment analytics in your hands allows you to optimize sales and marketing strategies to boost further sales.

Most payment gateways offer a report you can download weekly or monthly to reconcile the payments. Every report consists of a list of transactions made within the settlement cycle. You will be able to identify the following through these reports:Date and time of a specific transaction

- Transaction amount

- Order ID

- Date and time of settlement

- Merchant discount rate

- Net settlement amount

Furthermore, the settlement reports include the adjustment made in every settlement cycle. The adjustment means any accommodation made in the next settlement cycle through the payment gateway.

4. Supported Countries

Not confirming with the payment processor the countries they operate in could be a grave mistake. Because not every payment processor operates in all locations. For instance, Stripe for businesses is only available in 47 countries, whereas PayPal is available in more than 200 regions. And if you end up choosing Stripe for a location it doesn’t support, your business will take a direct hit both reputation-wise and financially.

Therefore, always check with the payment processor which countries it supports. If and only if it supports the countries you want to do business in, go for it. Otherwise, look for something else.

5. Support for your Industry

Some payment processors don’t offer businesses their services because of the industry they operate in, especially when there’s a financial risk involved. Here are some of those industries:

- Gas stations where the rate of fraudulent transactions is high.

- Telemarketing sales or infomercials where the chargebacks are too high.

- Sale of marijuana or firearms that are regulated under federal laws.

If you belong to any of the above industries or something similar, your payment processor choices may be limited. Therefore, while choosing a payment processor, check with them whether they support the industry you operate in.

Wrapping Up

Although payment processors are an indispensable part of any online business, it never means you can choose whatever option tops the google search results. You need to put in some research and weigh your options to find what works best for your business and customers. However, as you have the aforementioned things to consider before choosing a payment processor, the job becomes easy.

Just go through the pointers, and make sure your ideal option meets all the criteria, and you’re done. This way, you can make an informed decision and ensure a seamless payment experience for your customers.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

.png?width=150&name=karthik%20(1).png)

.jpg?width=50&name=IMG_5672%20(1).jpg)

.png?width=50&name=karthik%20(1).png)