Set up payments on your platform in minutes, not months!

Inai supports multiple

business models

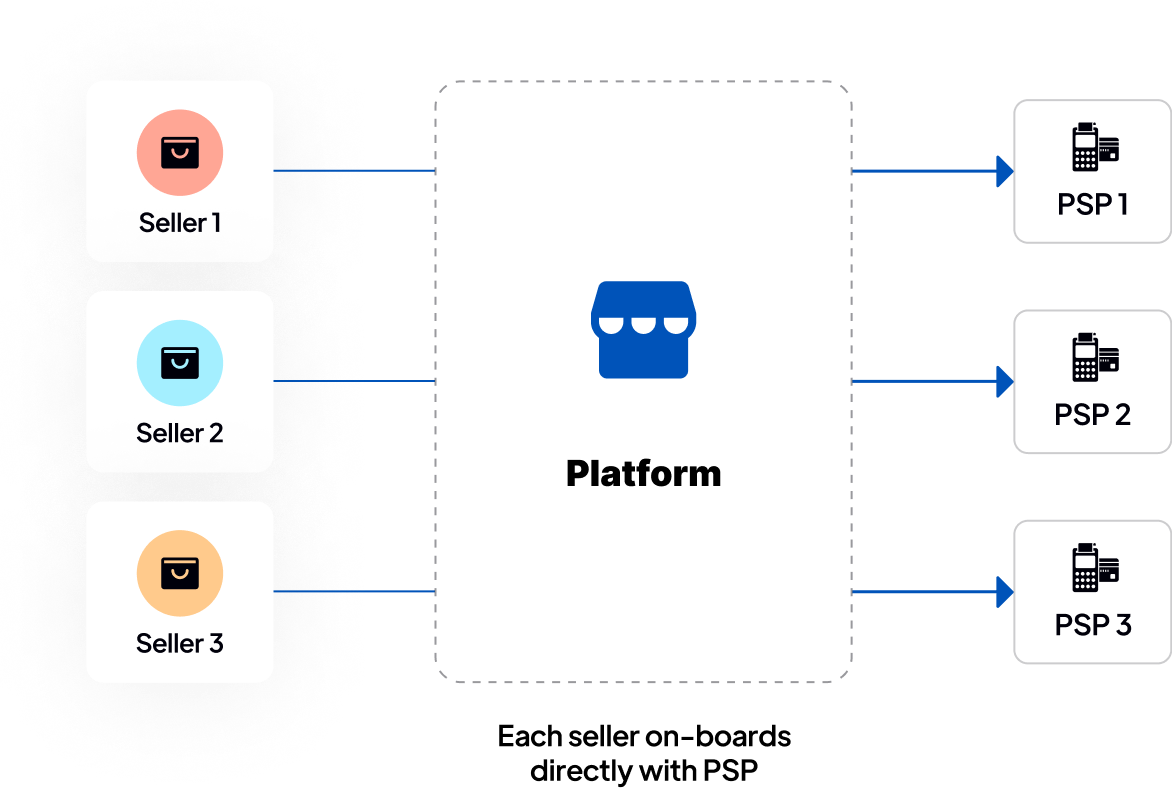

Merchant Acquiring Model

Customers onboard with any processor of their choice to accept payments within your platform and receive payouts in minutes. In addition, the Processor collects bank information and verifies IDs to meet KYC requirements.

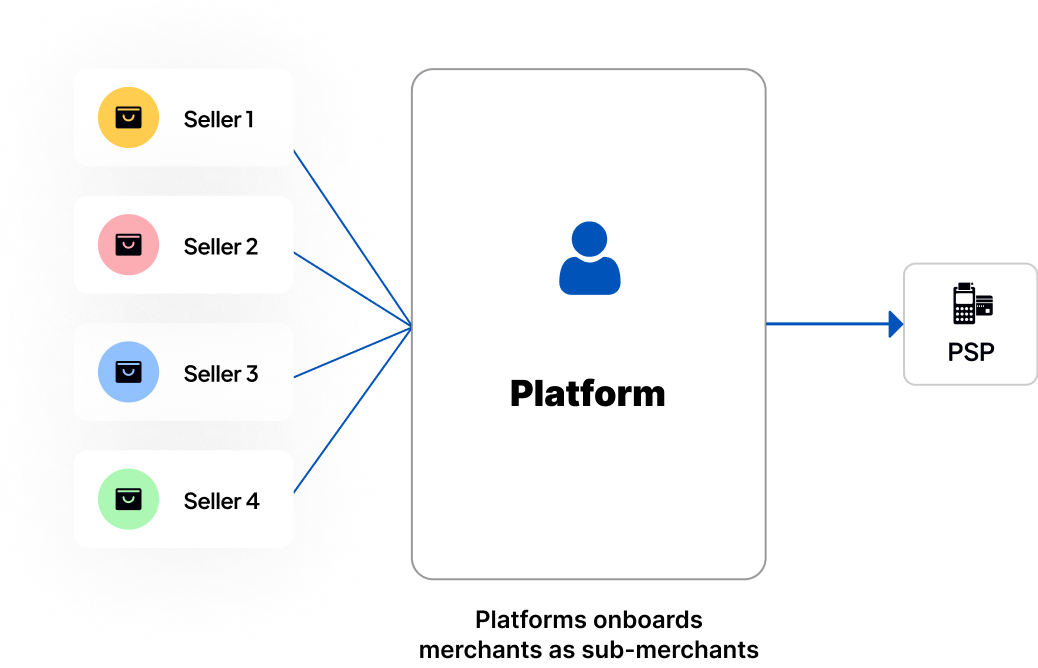

Payfac Model

Customer onboarding is done through a processor under your brand using the master KYC to accept payments within your platform and receive payouts. In this process, you take a cut of the sale proceeds based on the tier of sub-merchant.

Go Global and improve conversion with all payment methods

-

300+ payment methods

-

Localised checkout experiences

-

Conversion optimised: Vault for fast checkout, error handling, address autofill etc

Go Global and improve conversion with all payment methods

-

300+ payment methods

-

Localised checkout experiences

-

Conversion optimised: Vault for fast checkout, error handling, address autofill etc

Support flexible business models

.png?length=810&name=Group%205681(1).png)

(1).png?length=744&name=Visual(3)(1).png)

-

One time payments

-

Invoicing

Support flexible business models

-

One time payments

-

Invoicing

Give customers a full-featured dashboard to manage payments

(1).png)

-

Single Sign-on from your dashboard

-

Let customers manage refunds, add new PSPs and launch to new markets from inside your dashboard

(1).png)

Give customers a full-featured dashboard to manage payments

Every checkout option we offer is built to ensure you and your customers never have to worry about the safety of your money or data. Our system simplifies PCI-DSS and GDPR compliance, with flexible integration and Enterprise Grade security built-in.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)