Choosing the right payment gateway is a vital step when expanding your business into new markets. Just like the way we say 'hello' or the food we like to eat changes significantly when crossing the border - the same goes for how we pay.

There's a wealth of payment methods available in South East Asia, and like Europe, it's not a one size fits all market. The payment methods that shoppers choose can also wildly vary between demographics. This means that merchants need to offer the perfect selection at the checkout to convert shoppers and give them a smooth payment experience.

In this article, we’ll discuss the payment landscape in Indonesia, the best criteria for choosing a payment gateway, and a breakdown of the best payment getaways in Indonesia.

Current payment solution landscape in Indonesia

As the most populous region in the world, APAC is home to more than half the world’s total mobile subscribers. Consumers in the region already demonstrate a high willingness to use mobile payments and exceed the global average when self-reporting their participation in mobile banking activities. Spearheaded by the COVID-19 pandemic, there has been an explosion in the digital payments market in Indonesia.

In 2019, a government-backed scheme for a comprehensive digital payments system, known as Quick Response Code Indonesia Standard (QRIS), by Bank Indonesia, was introduced in Indonesia.

The new scheme allows consumers in Indonesia to pay using a QR Code method, which in turn ensures that the transaction process becomes easier, faster, and safer. Prior to QRIS, digital payments in Indonesia would only have been possible when both the merchant and the consumer were using the same digital payments provider.

Now, with the interoperability between the different payment system service providers: merchants only need to display one QR code, and consumers can make the transaction through their own preferred payment method.

The introduction of QRIS was mandatory to ensure digital inclusion for both merchants and consumers, however, as the release coincided with the global pandemic, meant that adoption was much faster than it would have, as merchants and consumers were increasingly aware of the risks of physical contact and looked towards contactless methods. As such, as of July 2020, QRIS has facilitated around 11 million transactions with a total value of about IDR 790 billion.

Read more about the popular local payment methods in Indonesia with our handy guide.

Criteria to Look Out For Payment Gateways in Indonesia

With so many payment gateways available it can be tough to choose the right one for your business. Always keep in mind that you'll want to have the gateway that's the most secure, cost-effective, and easy to manage.

Let's dive in:

Security:

With eCommerce and card-not-present fraud evolving at a rapid rate, payment gateways need to have the right security requirements to keep you and your customers safe from fraud. According to Integrity-Indonesia, while Indonesia reached 35 million online shoppers in 2017, shows that about 35% of e-commerce transactions are fraudulent.

To ensure that bad actors don't pass through the gate you'll need a payment gateway that's 3D Secure 2.0, PCI DSS Compliant, and Tokenizes transactions.

Read more about the 7 security measures that payment gateways use.

Pricing and cost-effectiveness

Payment gateway pricing is based on the different types of transactions that are happening and can vary depending on if they're eCommerce or online. Even business sales, revenue consistency, transaction frequency, and the markets served can affect the pricing structure.

It's important to compare how your business model will integrate with the payment gateways fees. Also, consider that there may be setup and contract fees, or pricing structures may change throughout the contract if a certain order and transaction volume isn’t met.

Reliability

According to theasianbanker.com 60% of Indonesia's population is equipped with a smartphone, and Indonesia's e-wallet transactions reached $18.5 billion in 2021. With such a switch towards mCommerce and eCommerce transactions, it's important for merchants to make sure that their payment gateway provides a smooth checkout experience that's optimized for different devices and networks. The ideal solution is to select a payment gateway system that doesn't slow down the payment processor for the customer.

Furthermore, merchants shouldn't forget that their own customer experience is also a good one. Choosing a payment gateway that has top-notch customer service across the channels of your choice, will make sorting any glitches or issues a whole lot easier.

Supported currencies

It goes without saying that the payment gateway you choose needs to be able to process the currencies that you want to be paid in. Or that your customers are used to paying in. Better yet, you'll save money on settlement conversion rates.

Payment options

The payment gateway should also provide the methods that you want your customers to be able to pay in. Choosing a combination of the most popular methods they use, plus any others that you’d like to offer, such as recurring payments or paying via installments will increase your checkout conversion rates.

Market integrations

Last but not least, you should check to make sure whether a native integration is available for your platforms and the ease of integration. When expanding into new markets, you want to set up shop as quickly as possible. Native integrations ensure a reduction of payment errors on the customer's end and higher conversion rates on yours.

12 best payment gateways in Indonesia

1. Xendit

Xendit is the leading payment gateway in Indonesia, the Philippines, and all of Southeast Asia. The payment gateway provides a range of services for merchants to effectively handle their payments. Merchants can go live in less than a day with a choice of Live URLs, Web/mobile checkout, or API integration. With a focus on SME's, over 10,000 small businesses choose Xendit as their payments provider.

- Setup: Free

- Transaction fee: Credit Card 2.9% + RP 2,000Bank Transfer RP 4,500

- Customer support: 8:00am - 10:00pm

- Supported payment methods: Credit Card AMEX, MasterCard, Visa, JCB

- Internet Banking BRI, BNI, Mandiri, BCA, Permata E-Wallet OVO, Dana, LinkAja

- Fraud management: yes

- Currencies: IDR, PHP, USD, SGD. MYR

- Integrations: JavaScript, Android, iOS, Node.js, PHP, Go

- Onboarding time: 3-4 days

Source of info: Xendit, Devathon

2. Doku

Doku is Indonesia's first Payments Technology company and offers a smooth way for merchants to accept online payments. What sets Doku apart is that is pretty great fraud management to protect customers and merchants alike, which have been honed for nearly a decade through machine learning. With more than 20 payment methods on offer and a short integration process, many merchants choose Doku as their payment gateway in Indonesia.

- Setup: Free

- Transaction fee: Credit Card Bank Fee + RP 2,500Bank Transfer Bank Fee + RP 2500

- Customer support: Email, Twitter, phone

- Supported payment methods: All major credit/debit cards, ATM Bersama, Prima, Mandiri Clickpay, BCA Klikpay, BRI e-Pay, Alto

- Muamalat, Danamon, Permata Net CIMBClicks, Kredivo, KlikBCA, BNI Yap and Doku eWallet.

- Fraud management: Yes

- Currencies: IDR

- Integrations: JavaScript, Php, XML

- Onboarding time: 1 week

Source Of info: Doku, Devathon

3. iPay88

iPay88 is one of the most popular payment gateways that Indonesia has to offer. Its low setup and transaction charges are a major plus for merchants. iPay88 offers mPOS that allows merchants to accept card payments and a range of alternative payments. Equipped with the latest fraud detection technology, 3D Secure (Verified by Visa & MasterCard SecureCode) compliance and fraud monitoring are also available.

- Setup: RP 8,000,000

- Transaction fee: Credit Card Bank fee + 2.5%, Bank Transfer RP 7,000

- Customer support: email

- Supported payment methods: Credit Card MasterCard, Visa, JCB, Amex, Union Pay

- Internet Banking BCA Klikpay, E-pay BRI, QNB, Maybank2U, Danamon, CIMBClicks, SBI E-Wallet OVO, LinkAja, Rekening Ponsel

- Fraud management: yes

- Currencies: IDR

- Integrations: Php, ASP, Android, iOS

- Onboarding time: 2-3 days

Source Of info: iPay88, Devathon

4. 2Checkout

2Checkout is one of the most popular payment gateways, with tens of thousands of merchants choosing them to be their payment partners. With 2Checkout it's easy to get global coverage through one simple integration. Merchants can enjoy the easy setup, with minimal and with 2Checkout they can quickly process payments for the most popular methods in Indonesia.

- Setup: Free

- Transaction fee: 3.9 % + $0.45 USD1.5% cross-border fee

- Customer support: Open 24/7

- Supported payment methods: All major Credit/Debit cards PayPal, Apple Pay, Android Pay, Indonesia Bank Transfer

- Fraud management: Yes

- Currencies: All major currencies

- Integrations: Java, Ruby, .net, C#, Python

- Onboarding time: 1-2 days

Source of info: Devathon, 2Checkout

Good read: Top payment gateways in the USA

5. PayPal

Of course, almost everyone has heard of PayPal. In Indonesia, they provide a reliable and secure payment gateway with a wealth of payment options. While PayPal doesn't offer a vast variety of alternative payments, merchants can easily integrate with the most popular and widely used methods through the PayPal gateway.

- Setup: Free

- Transaction fee: Domestic 3.9% + RP 2.00, Cross border4.4% + Fixed fee-based

- on the currency received

- Customer support: Help centre

- Supported payment methods: Credit or Debit Card Visa, MasterCard, Discover American Express Indonesian Bank Transfer

- Fraud management: yes

- Currencies: 24 Currencies (USD, RP, Euros, GBP, Yen, SGD and more)

- Integrations: Java, .net, PHP, python, node, ruby

- Onboarding time: 1-2 days

Source of Info: Devathon, PayPal

6. Midtrans

Midtrans, previously Veritrans, was founded in 2012 with a mission to provide online businesses in Indonesia with a payment gateway that is safe, reliable, and fraud-free. Midtrans takes the user experience of the merchant and customer seriously and aims to make payments as simple as possible. Midtrans also offers the most payment methods of any other payment gateway in Indonesia that’s featured on this list.

- Setup: Free

- Transaction fee: Credit Card 2.9% + RP 2,000Bank Transfer RP 4,000

- Customer support: 24/7

- Supported payment methods: Credit Card AMEX, MasterCard, Visa, JCB

- Internet Banking CIMB Clicks, Bank BRI, BCA KlikPay, Danamon, ePay Mandiri ClickPay

- E-Wallet Mandiri, GoPay, Line Pay, XL Cash, BBM Money, Indosat Dompetku, tCash

- Fraud management: yes

- Currencies: IDR

- Integrations: PHP, Ruby, Nodejs, Python, Java, Go Android, iOS

- Onboarding time: 2 weeks

Source of info: Devathon

7. FasPay

Faspay is the First Official Payment Gateway in Indonesia with over 8 years of experience working with startups all the way up to corporations. The main objective of Faspay is to help merchants to accept all types of payments, whether through debit transactions, major credit cards, or a wealth of alternative payments. Faspay uses data-based, machine learning to protect merchants' and customers' data and payment information.

- Setup: Free

- Transaction fee: Credit Card 3% + RP 3,000, Bank Transfer RP 4,000

- Customer support: 24/7

- Supported payment methods: Credit Card AMEX, MasterCard, Visa, JCB Internet Banking CIMB Clicks, Bank BRI, BCA KlikPay, Danamon, ePay, Bank Permata E-Wallet

- Rekening Ponsel, LinkAja

- Fraud management: yes

- Currencies: All major currencies

- Integrations: XML, Php, JSON

- Onboarding time: 1 week

Source of info: FasPay, Devathon

8. Rapyd

The self-declared largest payment gateway in the world, Rapyd is a payments platform that inserts fintech services into any app and simplifies the complex offering of local payment methods. With a focus on mobile-friendly solutions, merchants and consumers seem to love Rapyd! Rapyd's total payment volume is on target to pass $20 billion this year, a four times increase on 2020's volume of $5 billion!

- Setup: Free

- Transaction fee: N/A

- Customer support: email and knowledge base

- Supported payment methods: Local payment methods including cards, bank transfers, ewallets, and cash

- Fraud management: yes

- Currencies: N/A

- Integrations: PHP, Ruby, Nodejs, Python, Java, Go Android, iOS

- Onboarding time: N/A

Source of info: Rapyd,

9. Directa24

Directa24 is a payment gateway that specialists in emerging markets and as such as the only 360 payments technology platform for Latin America, APAC, and Africa. Dubbed as the fastest-growing global payment processor, Directa24 specialises in processing payments for the gambling sector.

- Setup: N/A

- Transaction fee: Varies per currency

- Customer support: Email

- Supported payment methods: Local payment methods including cards, bank transfers, ewallets, and cash. Bank Rakyat Indonesia, Bank Negara Indonesia, Bank of Central Asia

- Fraud management: N/A

- Currencies: EUR/USD

- Integrations: Java, PHP, Javascript

- Onboarding time: N/A

Source of info: Directa24, Gamblerspick

10. dLocal

dLocal is an Uruguayan payment getaway with a big presence in LatAm but is gaining a foothold in South East Asia. A popular choice among merchants, dLocal offers the most popular payment methods in Indonesia such as OVO and GoPay, and allows for transactions to be made in all major currencies for a reasonable fee.

- Setup: N/A

- Transaction fee: All-inclusive charges range between 2.7% to 7%.

- Customer support: Portal

- Supported payment methods: All major debit cards, Internet Banking CIMB Clicks, Bank BRI, BCA KlikPay, Danamon, OVO,GoPay, ePay, Bank Permata, E-Wallets Rekening Ponsel, LinkAja

- Fraud management: Yes

- Currencies: All major currencies

- Integrations: API

- Onboarding time: N/A

Source of info: dLocal,

11. 2C2P

2C2P is a payments platform provider that works with organisations of all sizes operating in emerging markets to accept omnichannel payments. With a large presence across South East Asia, 2C2P is a comprehensive payment solutions provider that offers many popular payment methods, that can help you gain a strong foothold across the region.

- Setup: N/A

- Transaction fee: 3.75% to 4.20%

- Customer support: email and phone

- Supported payment methods: All major cards, digital wallets, and over-the-counter at over 400,000 locations across South East Asia.

- Fraud management: Yes

- Currencies: IDR, USD

- Integrations: API

- Onboarding time: N/A

Source of info: 2C2P, Chargebee,

12. Adyen

Popular Dutch payment provider, Adyen, is one of the rising stars in the fintech world. With a strong presence in Europe, the payment provider is slowly but surely expanding its global presence. Adyen is one of the most trusted players in the market as it offers an omnichannel solution and the worlds leading alternative payment methods, it’s not surprising that Adyen is used by some of the worlds leading eCommerce brands such as LinkedIn, Booking.com, and SHEIN.

- Setup: Free

- Transaction fee: Varies per payment method and volume

- Customer support: 24/7

- Supported payment methods: Doku Wallet, Mastercard, Convenience Store, Visa

- Online banking, ATM payments, Dana, GoPay, Ovo

- Fraud management: Yes

- Currencies: All major currencies

- Integrations: PHP, Ruby, Nodejs, Python, Java, Go Android, iOS

- Onboarding time: 1-2 weeks

Source of info: Adyen

Local payment gateways and the rising complexities for businesses

Unfortunately, even with the sheer number of payment gateways on the market, there is not one payment gateway for each market that is a one size fits all. For merchants, it's becoming even more difficult to integrate with each payment gateway that they need, sometimes costing businesses hundreds of hours of manpower and resources in the engineering team to integrate and maintain.

Now, imagine a scenario where a payment gateway that is supplying your main payment methods goes down. That downtime will also be affecting your business, which you can have no control over until the payment gateway fixes the problem or integrates with another payment gateway.

But there's good news!

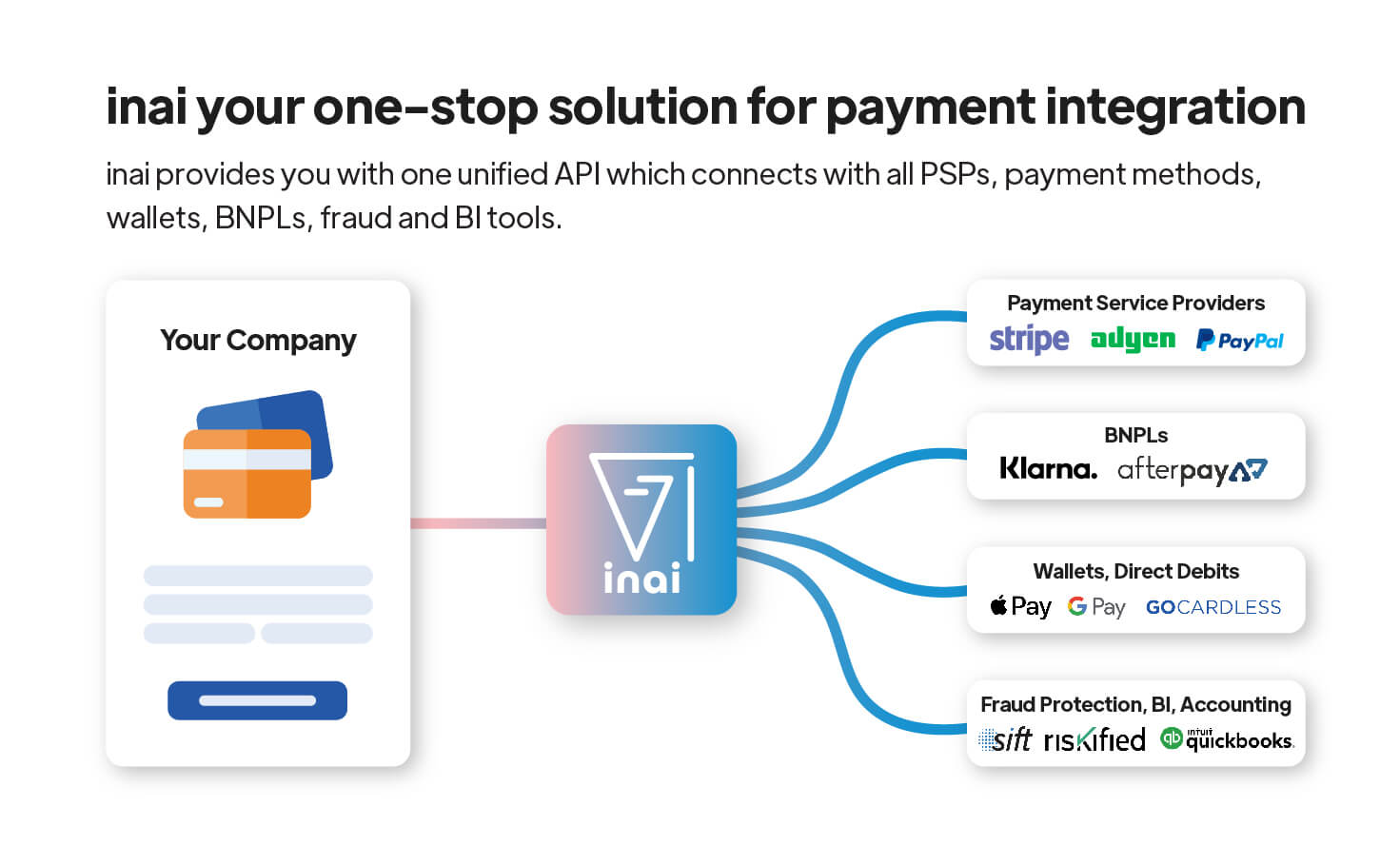

Luckily there are payment orchestrators like inai that can help you stop these potential problems in their tracks!

How inai helps merchants address multiple payment gateway integrations in Indonesia?

inai is a software layer that helps you integrate with more than 50 Payment gateways globally or domestically with a single integration. By having this added layer, you'll be saving engineering time and costs. But most importantly - you'll increase your checkout conversion rate by over 60%! How? Because you'll be supplying your customers with their most preferred payment methods and reducing checkout friction and disappointment.

inai is a software layer that helps you integrate with more than 50 Payment gateways globally or domestically with a single integration. By having this added layer, you'll be saving engineering time and costs. But most importantly - you'll increase your checkout conversion rate by over 60%! How? Because you'll be supplying your customers with their most preferred payment methods and reducing checkout friction and disappointment.

With an inai integration, you can set up shop in less than 60 mins with no code. You'll even be able to customise your checkout to your branding and direct each customer to a designated payment gateway based on the best transaction pricing and success rate.

For example, if Razorpay is providing you a lower cost on the major credit card schemes but choosing Cashfree has a better price for all other methods than Razorpay. Then you can choose Razorpay for cards only & Cashfree for all other modes & Vice versa with just a click. No coding is required. Better yet, with inai you can monitor the success rate between each gateway and quickly choose between the best payment gateways for you. As a result, you'll be able to concentrate on your critical business tasks and create superior products and services for your company.

.png?width=123&height=71&name=inai%20logo%20-%20dark%201(1).png)

%20(1).png?height=400&name=Header%20-%20Top%20Payment%20Gateway%20in%20Belgium%20(1)%20(1).png)

.jpg?width=50&name=IMG_5672%20(1).jpg)

.png?height=400&name=Header%20-%20Top%20Payment%20Gateways%20in%20Finland%20(1).png)